Cockroaches and active mutual funds

Nov 20, 2020Much has been made in the news about the demise of high-priced active mutual funds. The money flows have been enormously in favor of index products for a number of years now. This has led some to suggest that active management is all but dead and that index funds pose some mortal danger to the financial system. The drama for investing nerds.......

My experience says otherwise. Despite enormous amounts of data showing how drastically active funds under perform index funds in the aggregate, I am constantly running into folks who will never shift to low cost indexing. Why? For the same reason why people keep showing up at casinos.

There are in fact winners on any given day at a casino. Try telling someone who just won $ 1,000 at the slots that the odds were not in their favor. They will be 'high' on the money and unwilling to listen. They may even admit that the probabilities are not in most folks favor, but it worked for them!

These 'animal' spirits are what we are all up against. If an individual has experienced any sort of perceived success investing in a high priced active fund, the data isn't compelling. What is compelling is the rush they felt on the way up. Let's see how simple the data is:

What percentage of active funds beat their index? A substantial number.

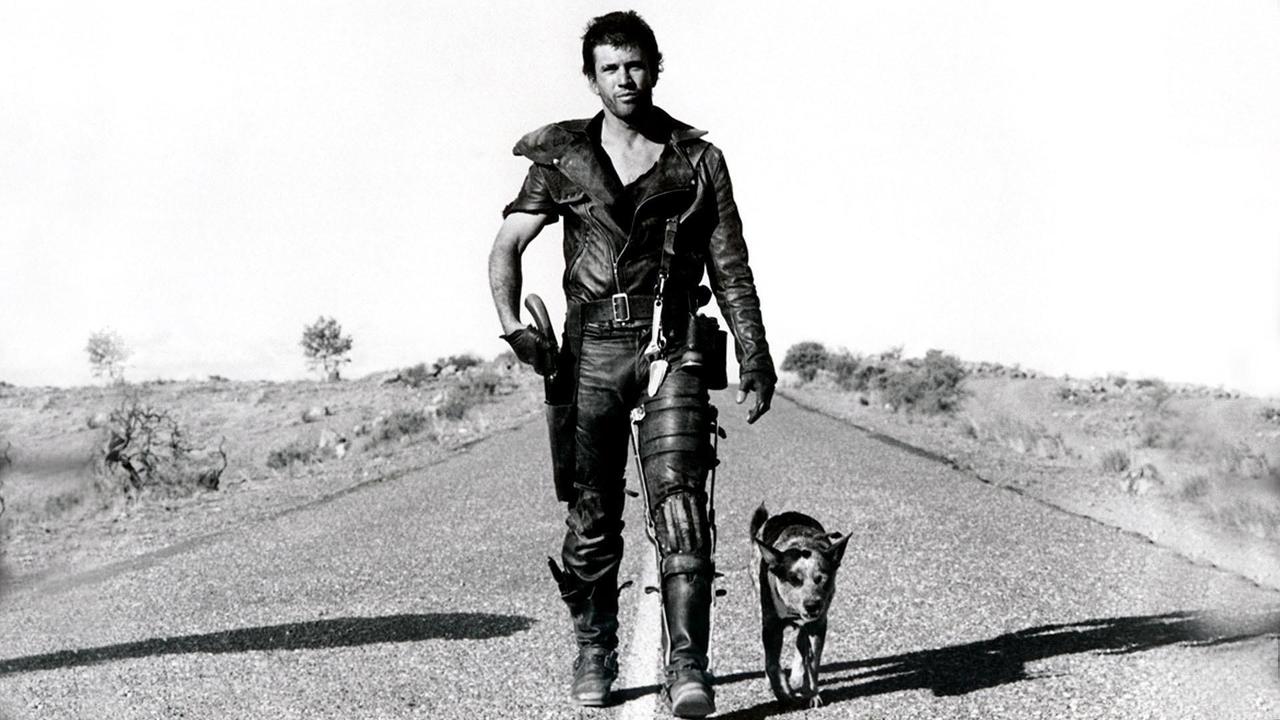

So yes, if we ever enter into any Mad Max dystopian future, there will still be cockroaches and active mutual funds. Human nature demands that active funds will stick around, and cockroaches are so stinking crafty.

In my work as a financial adviser, I seek to convince clients to adopt simple, low-cost, investment plans. Sometimes I succeed, but not always. Click the link below and give me a try, you may never enter a casino or purchase an active fund again.