Should you become a financial minimalist?

Nov 29, 2020Minimalism is making a bit of a comeback. All of humanity was a minimalist until the industrial revolution. It was too expensive to become a hoarder of objects. As the cost of those goods has continued to drop, and people have come to realize how many things they actually have (300,000 items is the average in an American home), a movement has begun to use less, as a way of clearing ones thinking and reducing stress.

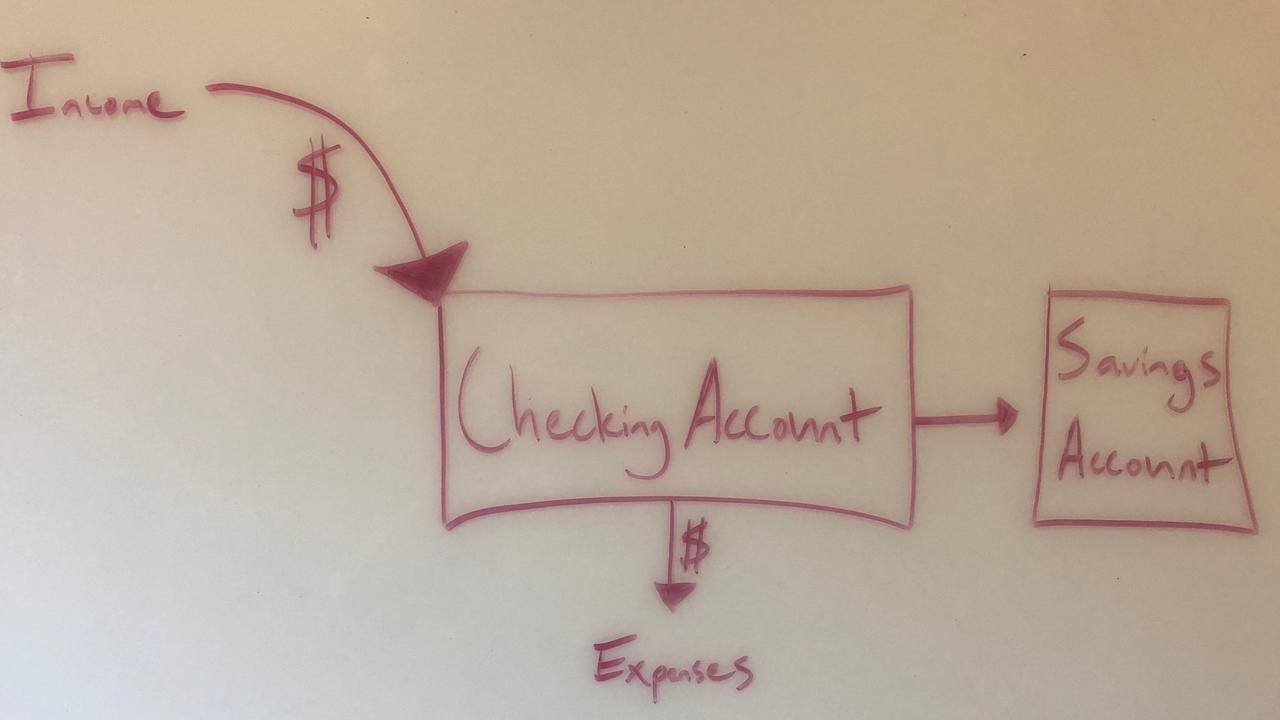

Should the movement include our personal finances?

Too simple you say? At least you know where your money is. You could even remove the savings account and be ok. One debit card will do. What about my investing you say? Most investors earn pretty terrible returns when you include timing the market and exorbitant fees. In no way is this optimal for most, but it may be a solution for some folks.

The above situation is common. As the proliferation of financial products increases, so has our collection of them. You change jobs, you get a new IRA, your employer recommends a jillion funds to hold in your 401k, you try a couple cool credit cards, an online savings account has a good rate etc… The above may be optimal, but is it manageable? My experience informs me that situations like the above are fraught with waste and redundancy. Additionally, the owners of the products are usually unable to tell you what they own and why.

Take a stab at being a financial minimalist. I suspect your decision making and clarity will increase.